The US Deputy Secretary of the Treasury, Wali Adimo, said he expects strong support from his counterparts in the Group of Seven major industrialized nations for the proposed 15% global corporate tax in addition to the minimum global corporate tax rate, which is expected to help bolster support in the United States. Congress for corporate tax legislation.

“My feeling is that you will see a lot of consolidated support among the G7 as it moves forward,” Adimio told Reuters on Monday after France, Germany, Italy and Japan commented positively on the Treasury’s proposal.

Adimio said this support could be expressed at a personal meeting of G7 finance ministers in London on June 4-5.

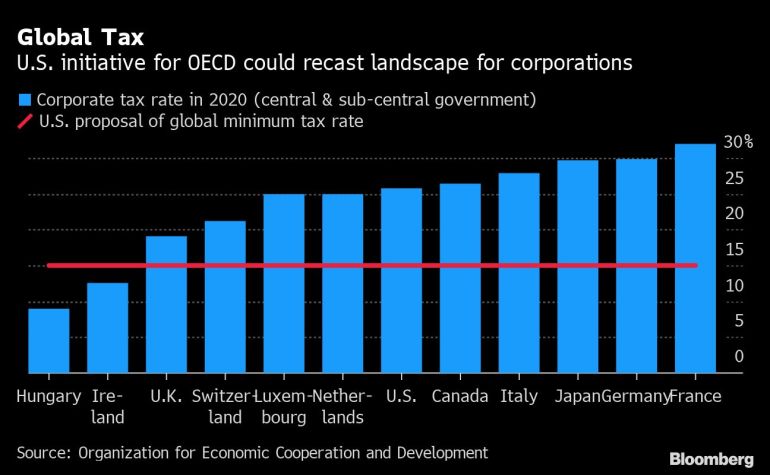

Optimism about a long-awaited global deal on how to tax the largest multinationals and digital services firms has increased since the Treasury Department said last week it would accept a global tax rate of 15% lower or higher.

The rate is well below the minimum 21% rate proposed by the Biden administration for US corporate income abroad and the proposed corporate tax rate of 28%.

The Financial Times reported on Thursday that the G7 nations are close to reaching an agreement on corporate taxation. While talks are taking place between nearly 140 countries through the Organization for Economic Cooperation and Development (OECD), the G7 countries – the United States, Japan, Germany, Great Britain, France, Italy and Canada – have a strong influence on multilateral decisions. .

Britain, the chair of the Group of Seven, which is currently imposing a 19% corporate tax rate, responded with more caution. When asked whether Britain would support Washington’s proposal by as little as 15%, Prime Minister Boris Johnson shifted the focus to taxing major tech companies such as Alphabet Inc and Facebook Inc.

“Reaching an international agreement on how to tax large digital companies is a priority and we welcome the United States’ renewed commitment to finding a solution,” Johnson said.

The proposed global minimum tax rate in the US is expected to be a major topic of discussion at the default meeting of the G7 financial leaders on Friday.

Reform is required

Ademu, who is taking part in the tax talks at the Organization for Economic Co-operation and Development, said he expects a broad international commitment of 15% or more to rally support for Congress to increase US corporate tax by narrowing the gap. External averages.

In 2017, the Trump administration and Republicans in Congress lowered the US corporate tax rate to 21% and set a minimum tax rate on foreign income from intangible sources at 10.5%. Business groups, including the American Chamber of Commerce, have opposed any increase in US tax rates, arguing that this would put American companies at a disadvantage.

Ademo said imposing higher taxes in the US would provide incentives for other countries to move towards the US rate.

“If we can convince the world that they are ready to achieve at least 15 percent, that gives us an opportunity to return to international talks once local work is done.”

Senate Finance Committee Chairman Ron Wyden said he was encouraged by the Treasury’s progress in the negotiations.

“A global deal could support necessary reforms of US tax laws, ensuring that our multinationals have an incentive to invest in the United States and pay their fair share,” Wyden said.

Negotiators in tax talks at the Organization for Economic Cooperation and Development were aiming for a deal in principle this summer.

When the G20 financial leaders meet in Venice in July, Adimio said, there should be a good sense of unity around a low global tax structure. He added that there would be a lot of technical details of the work, so it might be necessary to wait for the G20 leaders’ meeting in Rome at the end of October.

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer