Occasionally it requires an outsider to entirely enjoy some thing.

Europe’s largest asset manager, Amundi Asset Management, has generated exploration displaying why U.S. stocks have outperformed the environment, and why that outperformance may well continue on.

Admittedly penned by two from its Boston business office — Craig Sterling, its head of U.S. fairness analysis, and Marco Pirondini, head of U.S. equities — Amundi created a difference involving the U.S. stock current market, which is a engage in on quite a few of the world’s most successful businesses, and the U.S. financial state.

The S&P 500

SPX,

has outperformed the rest of the designed earth, measured by the MSCI Europe, Australasia and Much East index

990300,

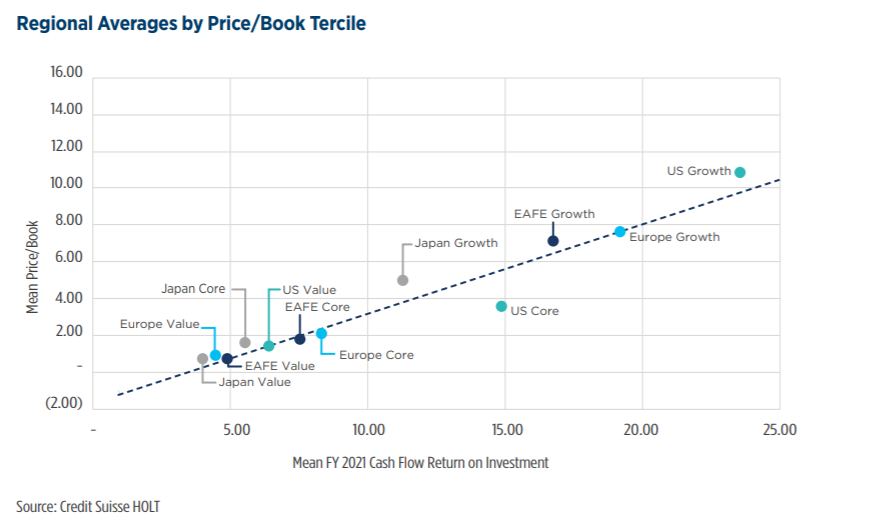

in 19 out of the last 30 decades, and with cumulative returns of 1574% as opposed to 235%. That is no incident, as U.S. organizations have greater financial gain margins and persistently topped their price tag of cash.

Amundi expects that outperformance to carry on.

“As we take into account the aftermath of the pandemic and recession, we believe that the economic uncertainty has created a deficiency of obvious earnings visibility, which will possible impair low-return organizations even additional. Past the decrease expense in innovation, technologies and well being treatment inherent in non-U.S. fairness markets, structural and economic pressures persist as expansion money expenditures are restrained,” it states.

When U.S. valuations are not affordable, investors get what they pay out for, with a much better income circulation return on financial commitment.

A lot of the outperformance stems from the U.S. dominance in technology, which the Amundi pair expects to keep on. “The mix of earth-course universities that create technologies and serve as launching pads for startups to commercialize it, a perfectly-developed undertaking cash sector, and a cultural willingness to choose possibility make it tough for other regions of the globe to surpass the U.S.,” the pair says, with only China proving to be a feasible worldwide competitor.

Moreover tech, financial and fiscal policies that put larger emphasis on the inventory current market are an benefit to U.S. equities, as are greater threats of shareholder activism and merger-and-acquisition activity. Decreased taxes and a flexible labor market also deliver a improve to U.S. marketplaces, the pair claims.

Uniquely, the pair supports the corporate lifestyle of stock buybacks, which are far less commonplace outside the U.S. “A crucial gain of share repurchases is that they empower the recycling of cash during the economic system, so capital may stop up in the most innovative palms and not trapped within of considerably less effective, additional experienced businesses,” Amundi suggests.

The buzz

On Tuesday, there ended up 53,507 new coronavirus scenarios in the U.S., a a few-week lower, according to details from the COVID-19 monitoring project. China, in the meantime, documented its greatest outbreak in weeks — 101 — as Japan and South Korea also see upticks in situations.

It is a large working day in Washington, D.C., where by the chief executives of the world’s greatest tech providers Amazon.com

AMZN,

Apple

AAPL,

Fb

FB,

and Alphabet

GOOGL,

will look through videoconference in advance of the Residence Judiciary Antitrust Subcommittee, starting off at midday Jap. The Federal Reserve announces its most recent desire-price final decision at 2 p.m., and Chairman Jerome Powell will hold a press conference at 2:30 p.m. Negotiations are predicted to go on on a new stimulus bill, with a massive rift on challenges which includes no matter if the $600 a 7 days added unemployment rewards are prolonged.

As earnings period carries on, General Electric powered

GE,

reported a wider-than-expected loss but better-than-predicted revenue and funds stream.

Superior Micro Equipment

AMD,

shares may access file highs, right after the microchip corporation noted next-quarter earnings that conquer expectations and amplified its full-12 months forecast. Starbucks

SBUX,

claimed a reduction on a 40% plunge in similar-retail store profits, but the coffee chain’s stock rose in premarket trade. Software firm Shopify

Shop,

surged right after a substantially more powerful earnings report than forecast.

The industry

Immediately after the 205-stage fall in the Dow industrials

DJIA,

on Tuesday, U.S. stock futures

ES00,

YM00,

NQ00,

pointed to a brighter start off.

Gold

GC00,

and silver

SI00,

futures sophisticated.

The yield on the 5-year U.K. gilt

TMBMKGB-05Y,

arrived at a file very low of -.135% before bouncing greater.

Random reads

MacKenzie Scott stated on Tuesday she has donated about $1.7 billion of her fortune above the earlier 12 months considering the fact that her divorce from Amazon Chief Government Jeff Bezos.

A trace? Democratic presidential nominee Joe Biden was photographed with handwritten notes about Sen. Kamala Harris, who quite a few feel will be his jogging mate.

There is an asteroid near Mars — and it was discovered by two Indian teenage women.

Require to Know starts early and is up-to-date right up until the opening bell, but indicator up here to get it shipped as soon as to your e-mail box. Be confident to examine the Will need to Know product. The emailed version will be despatched out at about 7:30 a.m. Jap.

Twitter fan. Beer specialist. Entrepreneur. General pop culture nerd. Music trailblazer. Problem solver. Bacon evangelist. Foodaholic.