(Bloomberg) – It’s an idea that would have stirred suspicion in the past: Option buyers could drive steep rallies in tech companies – and thereby push benchmarks to record levels – by stacking them in individual stock contracts. Such side bets, on conventional wisdom, would not have sufficient financial strength to move a $ 30 trillion market.

But after watching call volume explode at Apple Inc. And Amazon.com Inc. And Facebook Inc. And Tesla Inc. Recently, just as stocks have rallied, analysts have started adopting this theory. They assume that by acting boldly on a selection of high flying stocks at a time when the professional class freezes with indecision, traders can exert a significant influence. They say this push into call contracts created a bullish feedback loop as traders were forced to recalibrate hedges.

“In a world where volumes are distorted by the frenzied circulation of algae, any real flows of demand could have a surprisingly large effect on prices,” Peter Cher, head of macro strategy at Academy Securities, wrote in a note Tuesday. “By trading options, they are leveraging their position.”

Signs of buying options have been driving tech stocks into widespread speculation about who or what stopped the speculation. SoftBank Group Corp bought billions of dollars worth of options linked to US tech stocks over the past month, according to a person familiar with the matter. Bloomberg reported on August 11 that SoftBank was targeting bets of more than $ 10 billion – potentially up to tens of billions of dollars – in public equities using financing structures that could prevent it from appearing on public records as a direct shareholder.

SoftBank, in its August earnings call, said it had taken positions in some FAANG shares. “Our focus remains on the companies driving the information revolution,” SoftBank CEO Masayoshi Son said in the call. A SoftBank spokesman declined to comment on Friday.

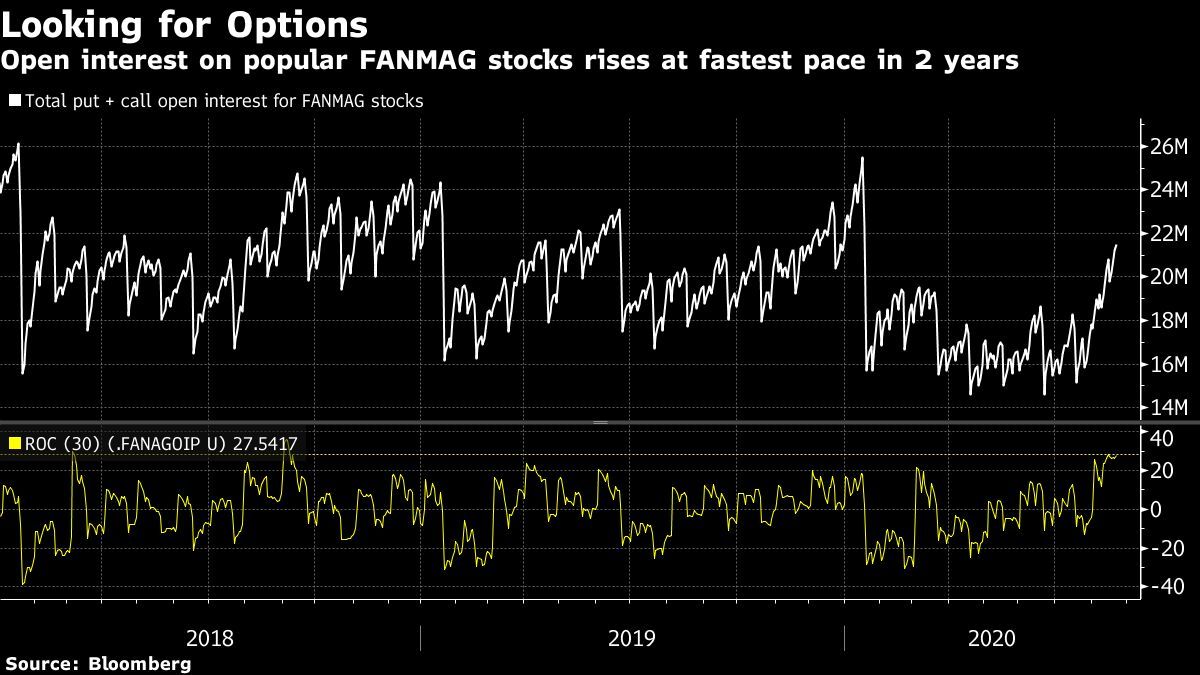

Whether it’s a single buyer or legions of everyday retailers – or a group where purchases by one arouse interest in the other – the footprint is visible in the stocks of popular tech mega-companies like Facebook, Amazon.com, and Netflix Inc. Google, Alphabet Inc, Apple and Microsoft Corp. Total open interest rose at the fastest pace since September 2018, before the Nasdaq 100 index declined more than 20%. The action was mostly in bullish buy options.

Volatility has largely turned in technology stocks over the past two days, with the Nasdaq 100 index briefly dropping to a 10% correction on Friday. Reversals like this week point to the risk that whatever pressure the options market may have spurred down the road, it is able to exacerbate moves to the downside when selling rises in cash stocks.

Amazon averaged 146,000 call volume in the 30 days through Wednesday, near its most active level ever. In the late 1990s, the parabolic scale peaked around half that. Meanwhile, Apple’s call options averaged over 3 million per day, the most in six years. Facebook stats are similar: The volume of call options on average over this timeframe is the highest since 2013. Meanwhile, the volume of daily calling options in Tesla has again trended towards 2 million, a record high reached earlier this year in February.

With popular stock options like Apple and Tesla on hand after the stock split, there is reason to believe retailers helped drive the boom. Bloomberg reported that the disruptions across internet brokerage firms on Monday were triggered by a wave of retail investor demand following the splits.

Individual stock option volumes less than two weeks before maturity account for 69% of options volume, which is not far from a peak of 75% in late July, a record high in Goldman Sachs Group Inc. data. Dating back to 2013. The short the updated nature of the contracts is a hallmark of retailers, according to BTIG LLC.

Millions of new traders flocked to the markets in the US, seduced by the prospect of no fees and entertainment while being bored at home in the era of the coronavirus. In the three months ending in June, clients traded at retail brokerage firms such as E * Trade Financial Corp. And TD Ameritrade Holding Corp. And Charles Schwab Corp. The data shows that options trades placed by small investors have also rallied significantly, and the turnover of cash stocks has also jumped.

The increase in activity reversed the long-standing relationship between the stock and options markets, with implied volatility in the Nasdaq 100 rising even as the index rose to a new high. The “fear metric” touched a 30-day high along with the same index that hit a multi-year high just twice before, according to Sundial Capital Research Inc. In January 2006 and October 2007, the two events were followed by major setbacks.

Apple’s division from 4 to 1 and Tesla’s division from 5 to 1 increased the speed of day traders entering the options space. While stock splits usually only lead to a temporary spike in the share price, they have become more important in the era of the day trader, according to RBC Capital Markets. Although fractional stocks are available to individual investors, they are not found in the options market.

“While investors can own fractional shares, most of them cannot own fractional options,” Amy Wu Silverman, RBC derivatives strategist, wrote in a note Wednesday. “After splitting the stocks, the retailer will have more trading options accessible in previously high-priced stocks.”

Before the stocks split, the number of bullish buy contracts pending was already rising. The average open interest for calls on Apple was more than 8 million in the seven days through the end of last week, compared to less than 5 million four months ago. Total open calling interest on Tesla surpassed 4 million, up from 3.2 million in June.

The stock split has given new traders this year a tool to hedge their trades, according to JJ Kinahan of TD Ameritrade. He said that while it was likely that Apple and Tesla options were not previously accessible, one is now able to sell calls to boost returns or buy against shares to protect performance.

“It really allows the retail trader to get more involved in Apple and Tesla,” Kinahan, chief market analyst at TD Ameritrade, said in a phone interview. “It opens the market for options to people and allows them to start using another financial instrument.”

(SoftBank purchase details updates in fourth and fifth paragraphs)

For more articles like this, please visit us at bloomberg.com

subscribe now To stay ahead of the curve with the most trusted business news source.

© 2020 Bloomberg LB

Twitter fan. Beer specialist. Entrepreneur. General pop culture nerd. Music trailblazer. Problem solver. Bacon evangelist. Foodaholic.