It does not make considerably sense for the dollar to be as broadly made use of as it is. Certain, the U.S. financial system is the major in the entire world, but the dollar is on 1 side of 88% of all forex trades, irrespective of the U.S. accounting for approximately a quarter of international gross domestic product. Nations around the world, most notably China and Russia, also are upset the U.S. is capable to wield its forex dominance to sanction government officers across the planet.

But even as the dollar has fallen 8.5% from the highs of March, according to the WSJ greenback index

BUXX,

there is nevertheless no very clear route or even plan on how to change the dollar’s function in the global economic process. It was only a 12 months ago that former Lender of England Gov. Mark Carney proposed Facebook’s Libra cryptocurrency could be a substitution, an strategy that now appears ludicrous presented the project’s struggles, even as Carney’s critique in excess of greenback hegemony proved apt when there was a greenback shortage in the course of the starting of the coronavirus pandemic.

Brad Setser, senior fellow at the Council on International Relations, would make one more point.

“A weaker greenback tends to direct to much more intervention by nations wanting to shield their exports in the international trade market place, and consequently a lot more reserve accumulation,” he says in a blog site put up this 7 days. “A weaker greenback consequently typically effects in higher not reduced desire for dollars from the world’s reserve supervisors.”

And how do these reserve managers accumulate pounds? By shopping for U.S. Treasurys, which arrives in handy as the U.S. is issuing personal debt at a immediate price, as the most up-to-date funds deficit quantities launched on Wednesday fortify.

Setser says a selection of international locations have been back again in the marketplace in June and July actively performing to depreciate their currency — singling out Thailand, Taiwan, Singapore and India in unique.

“Many export-based economies with big exterior surpluses are prepared to enable their forex drop against the greenback, but they remain hesitant to let their currency recognize against the greenback when the tide turns. And so the bulk of the world’s accumulation of dollar reserves has tended to arrive when the industry is pushing the dollar down not up,” he writes.

The buzz

Preliminary jobless promises fell sharply in the newest week, with condition claims totaling 963,000, a drop of 228,000. Which is the first time during the pandemic that claims have been beneath 1 million.

Community products and program maker Cisco Devices

CSCO,

noted a revenue decrease and soft earnings steering for the latest quarter, and announced its chief economic officer will retire.

Conglomerate 3M

MMM,

reported profits developments enhanced in July, and luxury items maker

TPR,

described a narrower-than-forecast reduction.

Apple

AAPL,

is readying a sequence of bundles that will permit customers subscribe to various of the company’s electronic services at a lessen regular monthly cost, in accordance to a Bloomberg News report.

The U.S. reported tariffs on European Union merchandise will stay unchanged, despite initiatives by plane maker Airbus to shift into compliance with a Environment Trade Business selection above point out support. Also on the trade entrance, a range of U.S. providers have lobbied the White Home about the final decision to ban the social-media application WeChat, according to The Wall Road Journal.

The marketplaces

The S&P 500

SPX,

is in just touching length of a closing file superior, and U.S. inventory futures

ES00,

YM00,

NQ00,

turned bigger.

The generate on the 10-yr Treasury

TMUBMUSD10Y,

rose to .69%.

The chart

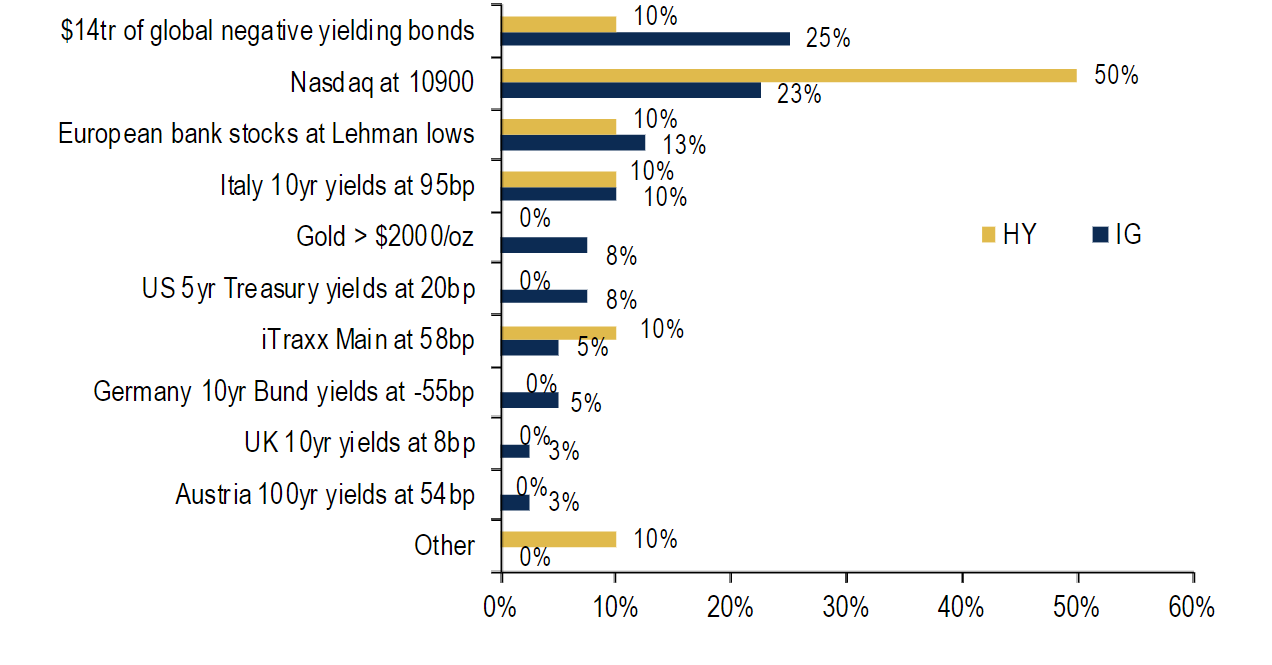

Lender of The united states took a poll of European credit traders about what anxieties them. Expenditure-quality buyers worry most about detrimental-yielding debt and the surging Nasdaq

COMP,

when large-yield buyers are additional anxious about the relentless rise in the Nasdaq than everything else. The existing depressed valuations of European bank stocks

SX7E,

arrived in 3rd for both equally sets of traders. August’s study, in accordance to Lender of America, also exhibits that credit score investors have absent “all in,” pushing overweights to the highest on report with a net 62% obese. Not only is what investors phone monetary repression (central lender motion) also difficult to fight, provide is set to drop following organizations issued credit card debt previously in the yr.

Random reads

Seemingly there has been a flood of social-media posts saying Sen. Kamala Harris, Democratic presidential nominee Joe Biden’s managing mate, isn’t qualified to be president. She is.

Wind and solar electric power accounted for a file share of electrical power in the initially fifty percent of 2020.

Prince Harry and Meghan, Duchess of Sussex, are now California householders.

The observatory featured in the James Bond film “Goldeneye” has had to briefly shut down.

Have to have to Know starts early and is up-to-date until the opening bell, but signal up in this article to get it delivered as soon as to your email box. Be positive to check the Want to Know item. The emailed version will be despatched out at about 7:30 a.m. Japanese.

Twitter fan. Beer specialist. Entrepreneur. General pop culture nerd. Music trailblazer. Problem solver. Bacon evangelist. Foodaholic.