Stimulus and massive spending shifts, wiping out entire industries and fattening others.

by Wolf Richter For Wolf Street.

American consumers – let’s face it, consumption is the number one job at the top during these trying times – they have pushed their credit cards again.

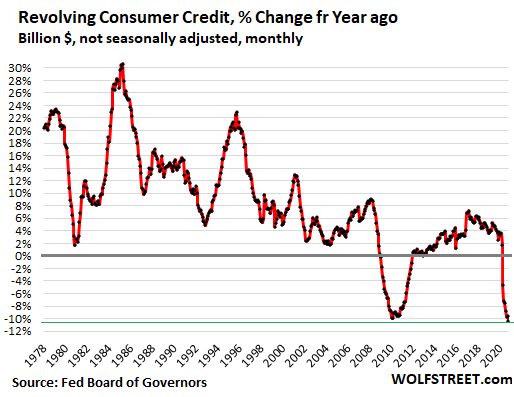

In October, credit card and other revolving credit balances fell again from the previous month, down 10.3% from October of last year, the largest annual drop ever, as it surpassed the peak annual decline during the financial crisis (-9.9% in January and February 2010). ):

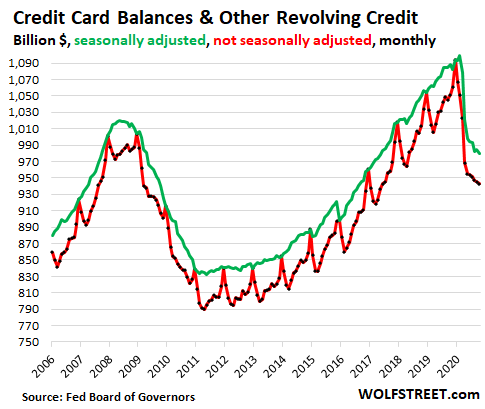

On a seasonally adjusted basis, credit card and other revolving credit balances have decreased to $ 980 billion (green line in the graph below), according to Federal Reserve data Today noon – a balance first seen in October 2007, despite 13 years of inflation and population growth.

Unadjusted seasonally, credit card and other revolving credit balances have fallen to $ 943 billion (red line), a balance first seen in August 2007. Since a peak in December last year, balances have decreased by $ 151 billion.

And this is something we’ve seen in other data: Seasonal adjustments can no longer adequately deal with new borrowing patterns that challenge seasonality. The classic seasonality of consumer borrowing, which has arisen over many decades and is quite predictable, has been avoided by events:

The massive drop in credit card balances in April was a result of the dual effect of stimulus payments that were applied to credit card balances and a lack of spending opportunities when large parts of the economy, where consumers typically use their credit cards to spend money, were closed, such as shopping malls, restaurants and cruises Aircraft and hotel travel.

Before the financial crisis, there was no year-on-year decline in revolving credit. For decades, Americans have been building up credit card debt with astounding passion and doubling increases annually in the early years, which allowed them to buy things and do things they could not otherwise afford, and it drove the American economy. The scheme continued until collapse during the financial crisis that caused the first ever annual decline. Now there’s its second year-over-year decline, and the steepest on record:

It is now becoming clear that there have been huge shifts in how and what consumers spend money on this The strangest economy ever, Wiping out entire industries and fattening others – with the net total remaining negative, i.e. a Decline in consumer spending compared to last year.

Spending was supported by additional stimulus money and unemployment benefits, and by record-low mortgage rates triggering a tsunami of mortgage refinancing lowering monthly payments, freeing up money to spend on things, while many homeowners refinanced Cash, encouraged by the rise in the prices of their homes, so some of that money freed up or borrowed for their house is spent on things, and part of it is used to pay credit card balances or prevent them from increasing.

And for those consumers who are able to pay for their credit cards, that’s a good thing, given that banks and credit card companies often charge usurious interest rates, such as 25% or more, in a zero interest rate environment.

For banks and credit card companies, it’s a difficult fate because the high interest rates they charge, this is where they make big money. There is no doubt that the Fed and economists are concerned about this development in consumers reducing the most profitable business for banks.

But consumers who are able to get out of their credit card debt, and walk away from it, should rejoice because there are so many things they can buy with money that they haven’t spent on 25% interest on $ 10,000 in credit card debt.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally understand why – but want to support the site? You can donate. I appreciate it very much. Click on a glass of beer and iced tea to see how:

Would you like to be notified via email when WOLF STREET publishes a new article? Register here.

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer