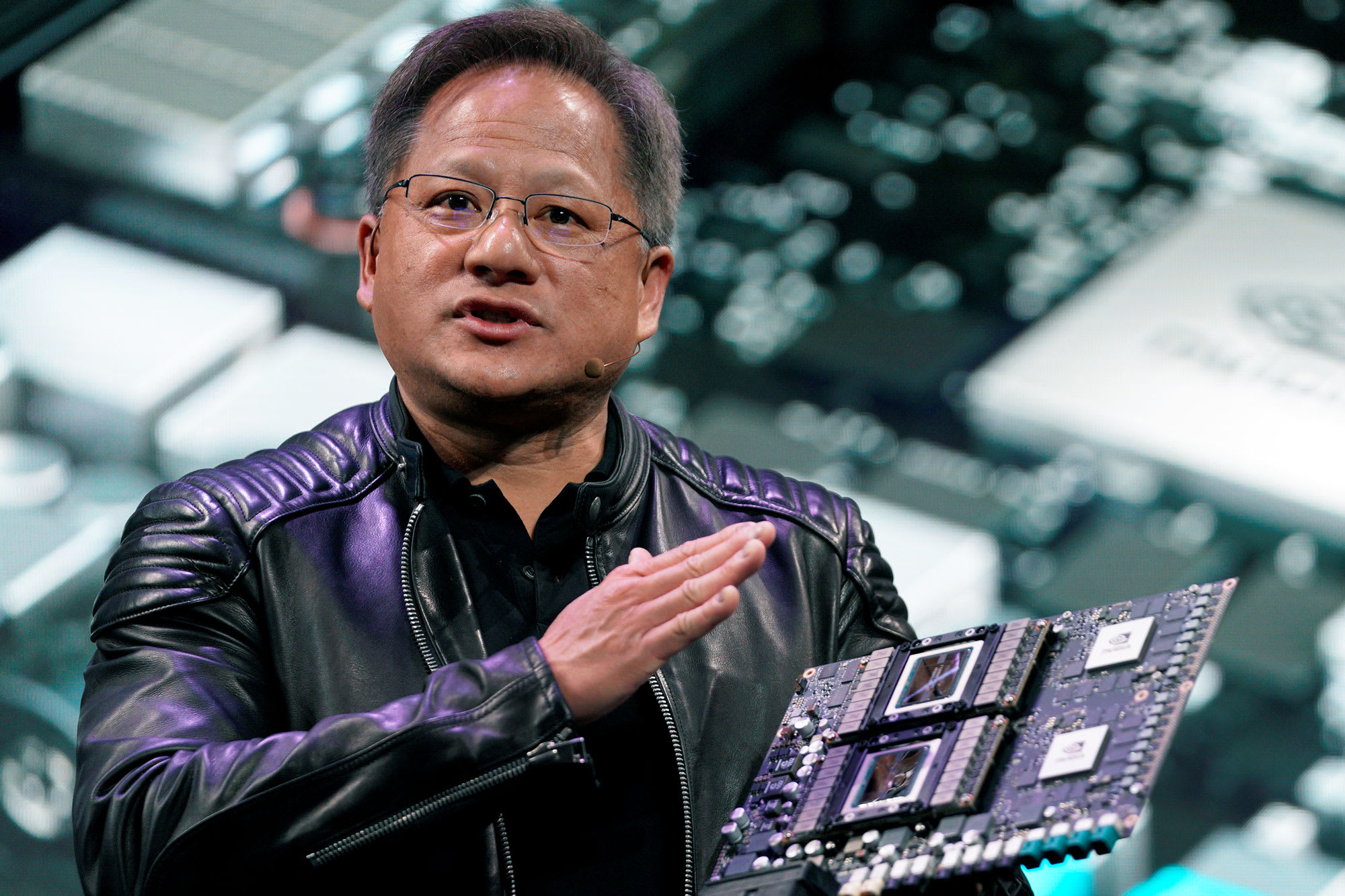

Jensen Huang, CEO of Nvidia

Rick Wilking | Reuters

Chipmaker Nvidia has agreed to buy Arm Holdings, a company that designs cell phone chips, from Softbank In a deal worth $ 40 billion, companies Advertise Sunday. The deal will include $ 21.5 billion in Nvidia shares and $ 12 billion in cash, including $ 2 billion paid upon signature.

Softbank acquired Arm in 2016 for $ 31.4 billion in 2016 in one of its largest acquisitions ever. Arm is best known as the designer of the architecture used in the chips in most mobile phones, including the Qualcomm chipset used in most Android phones, as well as Apple’s iPhone. Apple is also planning to Transform his Mac computers From Intel chips to an arm-based design.

Nvidia, whose chips are widely used to support graphics and artificial intelligence applications, including autonomous vehicles, has pledged that it will “continue the open licensing model and customer neutrality.”

Softbank Arm bought As an investment in the so-called Internet of Things – the idea that wireless connectivity between everyday items such as refrigerators, cars, and other devices would lead to useful new scenarios.

At that time, Softbank Chairman Masayoshi Son Reporters, “This is a company that I’ve admired for the past 10 years … This is the company I wanted to make a part of SofBbank. I’m very happy.”

However, SoftBank’s financial conditions deteriorated this year as the company lost money on investments in companies like WeWork And uber. Recently, the company Lost stock value It was said to have captured some large stakes in the tech giants, which suffered a loss in stock market value in early September. It’s unclear how much money SoftBank will actually make from the sale, given it has invested so much in Arm since the acquisition.

The company is also looking for money to help startups it has invested in through its Vision Fund, many of which have suffered during the coronavirus pandemic and subsequent closures. Earlier this summer it Advertise It will sell up to $ 21 billion of its stake in T-Mobile.

Communicator. Reader. Hipster-friendly introvert. General zombie specialist. Tv trailblazer