The FTSE 100 and GBP have come under renewed pressure as investors look to the prospect of a return of tighter coronavirus restrictions across the UK and most of Europe.

Market analysts pointed to a series of negative developments in value that drove the FTSE down as it fell 3% during the first two hours of trading on Monday.

191 pips traded – or 3.2% lower – at 5,817 at 10am with companies exposed to any news Covid-19 The restrictions, including travel companies and homebuilders, have sent their shares facing a renewed flight from risk.

Only five of the FTSE 100 index components were in positive territory.

British Airways owner IAG was the biggest loser, down 14%, leaving its shares down 77% in the year so far.

Also among the losers were the banks – which have been hit by the publication of a report alleging that a number of global lenders transferred large sums of illicit money over nearly two decades despite concerns about the source of the funds.

The Money laundering The claims, which spilled over to UK-listed HSBC and Standard Chartered, led to a drop of more than 3% in their respective share prices, pushing HSBC’s market value down to its lowest level in 25 years.

Another company that has taken a hit is Rolls-Royce which said Monday morning it is looking to raise as much as 2.5 billion pounds to boost its balance sheet.

The prospect of a rights issue helped reduce its shares by more than 10%.

It was a similar story for stocks across Europe after Asia started the week on the back foot.

The German DAX and CAC in Paris were 2.5% lower.

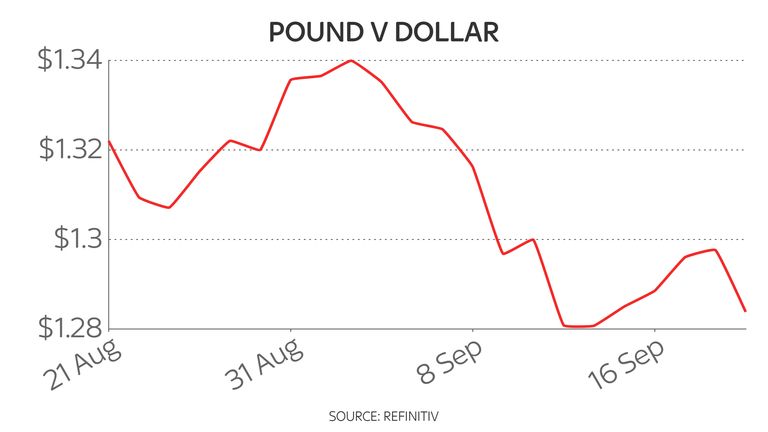

In the case of the pound, analysts pointed to fresh pressure from closing risks on the British economy, as it lost 0.5% against the dollar to trade at $ 1.2844.

The currency – a gauge of the state of the Brexit talks since the vote to leave the European Union in 2016 – has already faced weeks of difficulties as a result of difficulties in trade negotiations.

Investors are calling for a deal to follow the Brexit transition on January 1.

Markets.com chief market analyst Neil Wilson said stock market declines have been shaped by the “September blues” in the past few weeks that have seen the flash removed from US tech stocks.

European markets fell in early trade on Monday after US stocks fell for a third straight week – the first such sustained decline in a year.

“The FTSE 100 heads below 5900 while the DAX sheds 13000 as risk aversion spreads in equity markets.”

Of the virus’s link to the declines, he said: “The stricter rules are almost certain as the authorities get stuck and seem unable to get any kind of consistently clear approach to the pandemic.

“Travel and entertainment have been severely affected as new closures and travel restrictions are close to entering nearly half the time.”

Twitter fan. Beer specialist. Entrepreneur. General pop culture nerd. Music trailblazer. Problem solver. Bacon evangelist. Foodaholic.